What does coronavirus mean for your long-term financial goals?

As countries including the UK take tentative steps toward a return to ‘normal’ life, the effects of coronavirus continue to be felt around the world.

The impact of the pandemic on global stock markets has been well documented. During March alone, the FTSE 100 suffered its largest single-day drop in 30 years, followed by its second-highest one-day rise in history.

Meanwhile, back in April, it was reported that UK GDP could drop by 35% for the second quarter, with the Office for Budget Responsibility predicting a decrease of 13% for 2020 as a whole.

Whilst it might have been tempting – and maybe even understandable – for investors to panic during this period of pronounced, albeit short-term, volatility, our advice has been consistent: Keep calm and carry on.

So what has coronavirus meant for your long-term investments?

Why short-term volatility shouldn’t equal panic

There are many reasons why short-term market volatility needn’t cause investor panic. Here are just a few of them:

- Short-term volatility isn’t new

Brexit, US-China trade wars, the 2008 global financial crisis. Markets have suffered short-term blips before, and they will do so again. The cause might be new on this occasion, but the market will respond as it has always done.

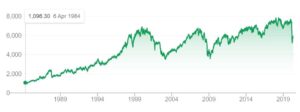

If we look at the performance of the FTSE 100 index over the last 30-plus years, we can clearly see the blips caused by the 2008 financial crisis and the 2016 EU referendum. We can also see the general upward trend of the market throughout the last three decades.

As advisers, part of our job is to use the knowledge we have of past stock market activity to help inform the advice we give you.

Ignoring the noise is a crucial part of investing, avoiding making emotional, knee-jerk decisions when times look tough can have a massive detrimental impact in the long term, once the markets recover.

- Your investments are long term

The financial plan you have in place is based on long-term investment. This long-haul approach allows for periods of short-term volatility, giving your investments time to recover from any short-term blips.

It is true that if you’re closer to retirement you might have less time for your pension fund to recover. To mitigate this risk, pensions can be ‘de-risked’ in the approach to retirement – moved into lower-risk funds – in a bid to consolidate previous gains at a time when large drops in value could have the most detrimental effect.

- Diversified portfolios

The most important thing to remember is that your portfolio is diversified. This spreads the risk of any short, sharp shocks in the market by investing in a wide range of asset classes. The effect of this is that if the FTSE drops 20%, the value of your investment portfolio won’t.

Why it’s important to take a long-term view

- It’s time in the market that counts

Time in the market is what’s important, not timing the market.

Whilst tumbling indexes might lead you into making emotional, knee-jerk decisions, remember that markets recover, and your money must be invested to make the most of a recovery when it happens.

This graph highlights the impact of ‘lost’ days, those times when a market recovers but without your funds invested.

The graph tracks the hypothetical growth of $10,000 invested in the US S&P 500 Index between January 1, 1980, and December 31, 2018.

As you can see, missing even the five best return-days over the length of a long-term investment could reduce returns by $232,550. Missing the best 50 days equates to an overall loss of $602,203 in potential growth.

Source: Fidelity

At Logic, we’ve seen short-term market dips before and are well placed to guide you through the difficult times, helping you achieve the best possible returns long after a given crisis is over, and markets begin to recover.

- Generally an upward trend

The UK-based company, IG, confirms that the ‘compound annual return of the FTSE 100 over the last 25 years was 6.4% with dividends reinvested. This would be a total return of 375%.’

We know that past performance is no guarantee of future success but it’s clear that the general trend of the markets is an upward one.

Long-term investment means holding your nerve when times are bad to reap the rewards once the general upward trend reasserts itself.

- If your goals haven’t changed, your plan doesn’t need to

The important thing to remember is that if your long-term goals haven’t changed, then your financial plan doesn’t need to either.

We’re here for you

At Logic, our financial planning professionals are here to help you through the tough times, helping you to achieve your long-term goals.

We remain committed to providing you with the same level of service we always have. That’s why it’s ‘business as usual’ even as we work remotely.

Get in touch

If you would like to discuss any element of your long-term financial plan, get in touch via email info@logicfinancialservices.co.uk.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.