This Winnie the Pooh day, what could the “silly old bear” teach you about investing?

Winnie the Pooh is one of the most beloved children’s book characters of all time. His adventures in the Hundred Acre Wood with Christopher Robin and their friends have delighted readers for almost 100 years.

On 18 January, the UK celebrates Pooh and his creator, AA Milne, on Winnie the Pooh Day.

He might be most commonly thought of as a simple bear with a penchant for honey, but dig a little deeper and Pooh’s philosophies on life could in fact make him a very shrewd investor.

This Winnie the Pooh Day, discover some of Pooh’s most insightful comments that could hold helpful lessons about investing.

1. “You can’t stay in your corner of the forest waiting for others to come to you. You have to go to them sometimes.”

You might not think of Pooh as a risk-taker, but he is always going on adventures with his friends in the Hundred Acre Wood. He frequently faces his fears and usually enjoys a good outcome as a result.

In much the same way, taking risk is an important part of investing. Keeping your money in the perceived safety of cash might seem sensible, particularly during market volatility, but this can mean sacrificing the long-term returns needed to help you achieve your goals.

So, taking an appropriate level of risk on your investments is usually a helpful way to achieve long-term returns.

Of course, risk does mean that your investments could fall in value as well as rise. So, consult your planner for guidance in choosing a portfolio that is aligned with your own personal attitude towards risk.

2. “It is more fun to talk with someone who doesn’t use long, difficult words but rather short, easy words like ‘What about lunch?’”

Pooh is a fan of keeping things simple, and when it comes to investing, this could be a good example to follow.

You might have seen people touting the benefits of investing in niche stocks or asset classes, promising positive returns in a short period of time. This is almost always a scam, designed to trick you into parting with your hard-earned money.

Instead of being taken in by the latest hype, it’s usually sensible to adhere to the key principles of investing, which tend to be simple and straightforward, even if they’re not the easiest thing to stick to.

These include:

- Diversify your portfolio

- Take an appropriate level of risk

- Take a long-term view of your investments

- Review your portfolio regularly and rebalance when necessary.

3. “Rivers know this: there is no hurry. We shall get there some day.”

As infuriating as it might sometimes feel when you’re excited to achieve your financial goals, the stock market cannot be rushed.

Just like a meandering river, returns can fluctuate, and sometimes growth happens more slowly than expected. This is all part and parcel of investing.

As investing sage Warren Buffett once said: “If you are not willing to own a stock for 10 years, do not even think about owning it for 10 minutes.”

4. “People say nothing is impossible, but I do nothing every day.”

By doing nothing every day, Pooh might make a great investor.

You might have heard theories about timing the market or star funds to invest in that can help you to beat the market. Evidence gathered from over 100 years of data shows that staying invested in a balanced portfolio throughout the inevitable ebb and flow of market volatility is more likely to generate long-term positive returns.

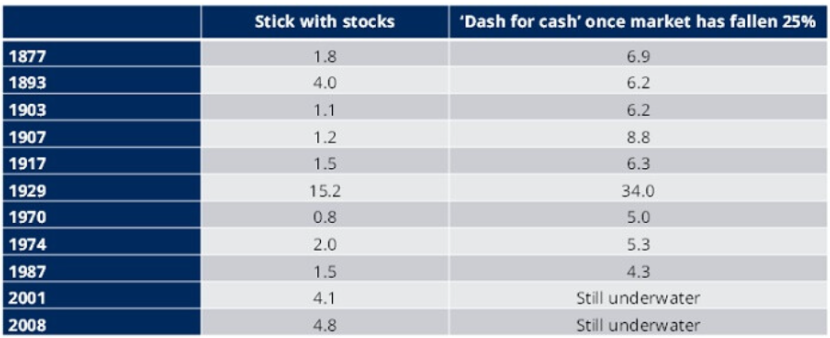

The table below shows how long it would have taken to recoup losses from stock market downturns if you had stayed invested versus moving your investments to cash. As you can see, those who did nothing and stayed invested were usually able to recoup their losses more quickly than those who moved their wealth into cash.

Number of years it took to recoup losses after historic stock market drops based on staying invested in stocks versus moving your money into cash

Source: Schroders. Remember that past performance is not a guarantee of future performance.

So, by being comfortable with doing nothing, Pooh might find that his investments perform more favourably than those who are constantly on the move.

5. “You never can tell with bees.”

Pooh has a bit of a love/hate relationship with bees.

On the one hand, they produce delicious honey. On the other, they have a habit of hiding their honey in nests high up in the trees where it’s difficult to reach. What’s more, they tend to sting him whenever he tries to help himself to the honey they’ve worked hard to produce.

You might have a similar relationship to the stock market. Of course, it’s a helpful vessel for growing your wealth over the long term, but it’s notoriously unpredictable and your investments can fall in value as well as grow.

Despite the challenge that the bees present to him, Pooh never gives up – but he does maintain a healthy level of caution when dealing with them.

“It’s so much friendlier with two”

Pooh’s friend Piglet said it best: just as in life, when it comes to investing, sometimes it helps to have a friend in your corner.

At Logic, we can support you in managing your finances and your investments so that you can feel confident in your ability to achieve your goals.

To find out more, please email us at info@logicfinancialservices.co.uk or check with your adviser.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.