The importance of staying calm when the stock market falls

In a climate of rising living costs and low savings rates, cash held in high street banks is effectively losing value in real terms.

Investments – in the right circumstances – can offer the chance for inflation-beating returns. With a long-term goal to focus on and a thorough understanding of your attitude to risk, the general upward trend of markets could mean that investing is the right option for you.

Even so, global events like Russia’s invasion of Ukraine can cause stock market volatility and could make you nervous, especially if you are new to investment.

Here are five key points to remember.

1. Short-term volatility is to be expected

From the 2008 global financial crisis to the EU referendum and the coronavirus pandemic, markets have reacted to uncertainty with short-term volatility. Markets took a similar drop on the day that Russia invaded Ukraine.

In this graph showing the FTSE 100 since May 2021, many short-term dips are visible, including a sharp drop on 24 February 2022 (the day of the Russian invasion) and a more sustained dip at the start of March.

Source: London Stock Exchange

While emotional reactions to the scenes emerging from the war are completely understandable, it’s important to keep your financial situation separate, not allowing emotion into the investment decisions you make.

2. Avoiding knee-jerk reactions

To understand the benefit of avoiding knee-jerk reactions, we need to look at the markets over the long term.

Looking at the FTSE 100 over the last five years shows both the effects of the war in Ukraine and that of coronavirus.

Source: London Stock Exchange

The dip in March 2020 marked the sharpest fall in the index for almost three decades. And while the recovery has been slow, the effect of selling shares at the outbreak of the pandemic is clear.

In the same way that a sudden drop in the price of your house wouldn’t cause you to sell it, neither too should you be in a rush to sell falling stock. A drop might well be followed by a rise and you’ll want your money invested when this happens, to reap the returns.

3. Focus on your long-term goals

Investment is a long-term proposition, which is why we only recommend investment with a goal in mind between 5 and 10 years or more in the future.

In the context of a 10-year investment, shorter periods of volatility become mere financial blips (notwithstanding the human tragedy at the heart of the war in Ukraine and the global Covid-19 pandemic).

A long-term investment allows your money to ride out periods of global uncertainty, giving you the best chance of achieving your financial goals.

When the markets fall, remember:

- Stay calm – remember that short-term volatility has happened before and will happen again

- Ignore the noise – paying too close attention to the reaction of your investments to global events can lead to emotional reactions or trend-chasing that aren’t focused on your long-term goals

- Stay invested – short-term dips are likely to be followed by market rises, so be sure your money is invested when the good times come again.

4. The trend of the markets is upward

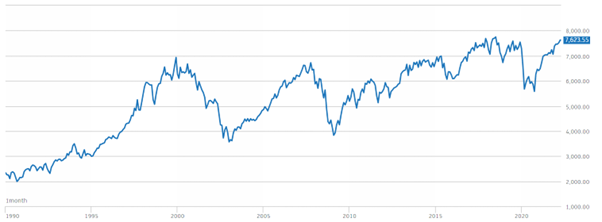

Markets generally rise over time, as shown by the same FTSE 100 index over the last 30 years.

Source: London Stock Exchange

The dips created by the Iraq War, the financial crisis, and Covid can all be seen. As can the general upward trend of the market.

The effect of investing for 10 years (at any period during these 30 years) is clear. While dips do occur, they tend to be followed by longer periods of rising prices, meaning that patience is key to seeing investment returns and achieving your goals.

5. Your investments aren’t the stock market

Finally, remember that your investments are not the stock market, or indeed the FTSE 100 index. A 10% dip in the FTSE 100 won’t result in a 10% drop in your investments. This is largely due to diversification.

You’ll need to understand your risk profile and capacity for loss to invest successfully. And then remember that investment isn’t a race to gain the largest returns in the quickest possible time. It’s about achieving your goals while taking the least amount of risk possible.

This is where diversification comes in, by spreading your risk across different asset classes, geographical regions, and business sectors. This means that a drop in one area will hopefully be counteracted by a rise elsewhere.

Get in touch

As financial planners, we have decades of experience dealing with changing markets. We can help you to build an investment portfolio that works for you and your risk profile, and then help you to ignore the noise and stay focused on your long-term goals.

We’re here to discuss any specific concerns you have so get in touch. You can email us at info@logicfinancialservices.co.uk or check with your adviser.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.