Saving into a pension: The Annual Allowance – could it affect you?

In his 2020 Budget, Chancellor Rishi Sunak made adjustments to how the Annual Allowance would be tapered. Many had been calling for changes to the system, not least those in the NHS.

The announced changes will be good news for a lot of people because the amount of income you can earn before you are affected has increased. However, for the highest earners, the changes reduce the minimum Annual Allowance. This makes future pension planning even more difficult.

So, what changes did the Chancellor make? How will they affect you? And how can we help?

A brief guide to your allowances

The Annual Allowance is the amount you can contribute to your pension in a tax year and receive pension tax relief. For the 2020/21 tax year, the Annual Allowance is £40,000.

In an attempt to control the cost of pensions tax relief, the Tapered Annual Allowance was introduced in April 2016. It brought in concepts such as ‘threshold income’, ‘adjusted income’, and the minimum pension allowance.

The 2020 changes alter the levels of income and allowances as follows:

| Dates (tax year) | Threshold Income | Adjusted Income | Minimum Pension Allowance |

| Up to 2019/20 | £110,000 | £150,000 | £10,000 |

| From 2020/21 | £200,000 | £240,000 | £4,000 |

Sorry…what?

OK, some explanations are in order.

- Threshold income

This includes all your taxable income; salary, bonus, pensions, rental income, investment income (this isn’t an exhaustive list, but you get the picture). You can then take off the gross amount of pension contributions made to give you your threshold income.

- Adjusted income

Adjusted income is the same as threshold income but adds in any employer pension contributions.

For those in Defined Benefit (DB) pension schemes, including teachers and NHS workers, the calculation is more complex, and you should ask us for help. (You should probably ask us for help in any case!)

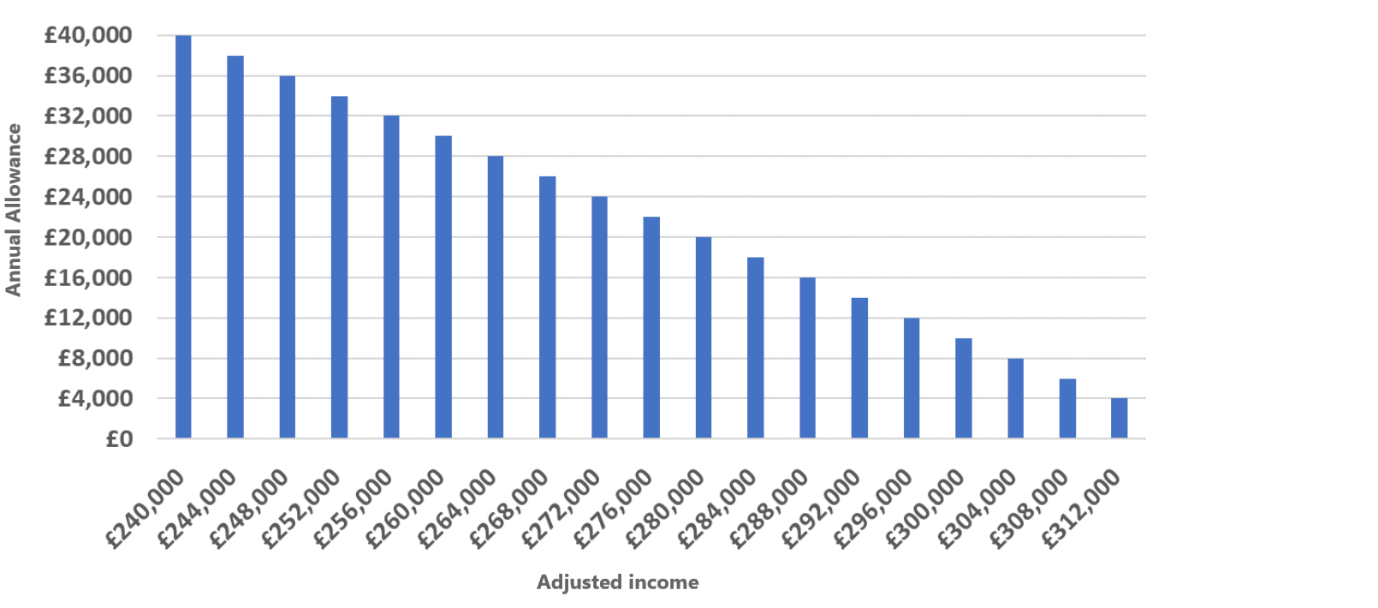

Simply, if you breach both the threshold and adjusted income levels your Annual Allowance reduces by £1 for every £2 adjusted income you receive, down to the minimum tapered allowance of £4,000. This means the maximum reduction is £36,000.

For the 2020/21 tax year, if your adjusted income exceeds £312,000 a year, the minimum tapered allowance will apply.

The table below shows how the taper would affect you.

Source: Pru Adviser

What do the changes mean for you?

If you were close to the old threshold amounts, the changes are good news. By raising the adjusted and threshold income amounts by £90,000 each, the Chancellor has given many high-earners much-needed breathing space and the ability to increase their pension contributions again.

For the very highest earners though the news is not so good. The new lowest reduced allowance of £4,000 severely limits the value of pension contributions you can make in a tax-efficient way.

These changes don’t just affect teachers or NHS workers. The taper and its cliff-edge amounts could affect high earners across all sectors.

If you exceed the allowance, you may become liable for an Annual Allowance tax charge. If you haven’t maximised your pension contributions in the last three years, you can carry forward the unused allowance from those years, but this is a complex planning area.

If you think you are impacted, please ask us to help. We can aim to make sure you don’t inadvertently exceed the limits while maximising your contributions from previous years.

The benefits of seeking advice

The Tapered Annual Allowance is a complex system and raising the thresholds – although good news for many – hasn’t addressed the underlying complexity. This makes the need for good financial advice as important as ever.

The first thing you can do is be aware that the changes exist – hopefully, this article has done that!

Then, if you think you are affected and want to understand what the changes mean for you, give us a call.

As financial professionals, we understand and track regulatory change. We can ensure the advice we give you makes full use of all available allowances and thresholds, and we can help you manage your finances in a tax-efficient way.

Get in touch

Get in touch via email at info@logicfinancialservices.co.uk if you think you may be affected by the changes to the Tapered Annual Allowance, or if you’d like to discuss any element of your long-term financial plan.

Please note

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits.