How could this year’s general election affect your investment portfolio?

The UK is set to head to the polls for a general election before the end of this year. It’s an important political event that can have ramifications for years to come.

As well as potentially affecting how the country is run, the election can have an effect on the UK stock market. That’s because, by its very nature, an election creates uncertainty about the future, which is uncomfortable for investors.

But the election needn’t be a reason to panic about your investment portfolio. Read on to learn more about how the stock markets might be affected and how you can mitigate the impact this may have on your portfolio.

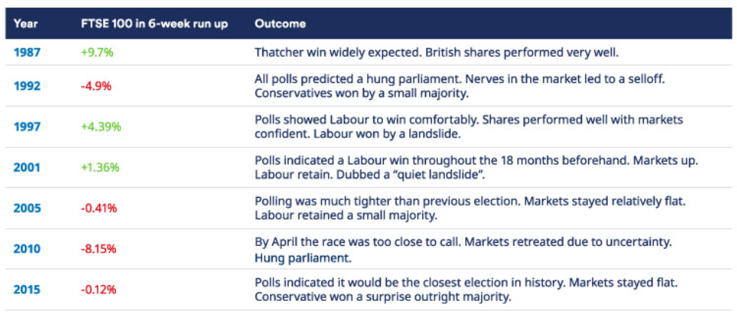

Markets can be volatile in the run-up to a general election

As a general election approaches, uncertainty about the result and its implications can create volatility on the stock market.

Schroders reports that the level of volatility is generally dictated by how close the result is likely to be.

The chart below shows how the FTSE 100 performed in the run-up to seven general elections in the UK. As you can see, the elections that had a likely winner tended to create more favourable conditions for the FTSE 100, whereas elections that were too close to call led to a drop in value for the index.

Source: Schroders

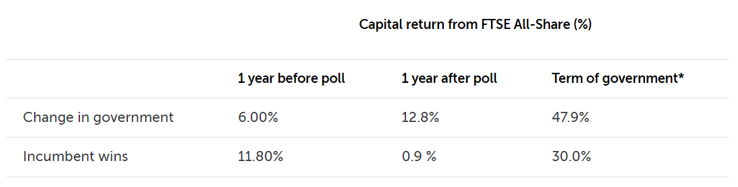

The outcome of an election can affect stock market returns

Once the result of an election is announced, the uncertainty that may have created volatility previously no longer exists. However, depending on the outcome, the stock market could still react unpredictably.

AJ Bell reports that an incumbent win could result in lower stock market returns than a change of government, according to data based on the FTSE All-Share during general elections since 1962.

Source: AJ Bell. *1964/66 to 1970 Wilson governments and 1974/74 to 1979 Wilson/Callaghan governments counted as one term. 2019 Conservative government to 5 January Labour governments can also point to healthy average stock market gains during the terms of their five prime ministers during the 42-year era of the FTSE All-Share

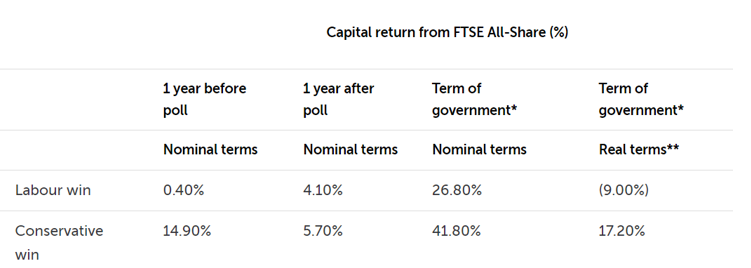

That said, the same data also suggests that Conservative wins have previously produced higher returns than a Labour win.

Source: AJ Bell. *1964/66 to 1970 Wilson governments and 1974/74 to 1979 Wilson/Callaghan governments counted as one term. 2019 Conservative government to 5 January 2024. **Adjusted for Retail Price Index (RPI)

So, while historical data can give us an idea of what might happen after the general election, in reality, it’s impossible to predict exactly how the stock market might react. That’s because it’s affected by many different factors at the same time, including the behaviour of thousands of individual investors.

With so many conflicting factors affecting the markets at once, attempting to predict the returns your investments might achieve in the near future is often a fool’s errand. It’s usually more sensible to focus on your own long-term goals than the short-term movements on the stock market.

A general election is unlikely to affect your investments long term

No matter how the stock market reacts to the general election this year, the effects are unlikely to have a long-term effect on your portfolio. There are two reasons for this.

- It’s usually sensible to hold your investments for a minimum of five years, ideally more. This time horizon is recommended because it gives your portfolio ample time to recover from any dips in value that you might experience during volatility. So, if the election does have a negative effect, in the same way that other global events have affected the stock market, over time your portfolio is likely to have the opportunity to recoup these losses.

- The UK stock market is unlikely to make up the entirety of your portfolio. Diversification across geographical regions and asset types is a key principle of investing. So, even if the UK stock market does face volatility, the investments you’ve made in other stock markets can mitigate the impact of this on your overall portfolio.

As you can see, though the upcoming general election may have an effect on the UK stock market, there’s no reason to panic or make changes to your investments.

Get in touch

If you’re concerned about how the general election or other world events could affect your portfolio, we can help. At Logic, we stay up to date with the latest movements on the market so that we can reassure you about your investments and the most sensible next steps for your finances.

Please email us at info@logicfinancialservices.co.uk or check with your adviser to learn more.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.