Giving while living – 5 loving ways to gift your wealth and reduce Inheritance Tax on your estate

If you’ve been following the series, you’ll know that an estimated £7 trillion is expected to transfer between generations over the next 30 years, this is the fourth in a series of articles about preparing for your own wealth transfer.

From essential family conversations to steps you can take to protect your estate from Inheritance Tax (IHT) and all the necessary paperwork to get your estate in order, there’s a lot to take in when preparing to transfer your wealth.

One primary objective for many is to ensure you’ve taken steps to pass as much of your wealth as possible to your family, and prevent it from being eroded by a potential IHT charge.

So, this month, find out how to get a head start on your wealth transfer, by using all your gifting allowances. One of the best benefits of this is that you get to see your family and loved ones enjoy their inheritance.

5 ways you could start gifting your wealth today

There are several gifting exemptions that, used effectively, could significantly lower your IHT liability. Here are five options you could consider.

1. Use your annual gifting allowance

In the 2025/26 tax year, the annual exemption allows you to gift up to £3,000 every year.

If you haven’t used the previous year’s exemption, you can carry it forward, meaning there may be potential to gift up to £6,000 tax-efficiently in the same year.

Better still, because this is an individual exemption, you can team up with your spouse or civil partner. If you both use your carried forward exemptions, together you could gift up to £12,000 in a single tax year.

2. Give money to family and friends as wedding gifts

Wedding gifts come with their own exemptions. You can gift up to:

- £5,000 to a child

- £2,500 to a grandchild or great-grandchild

- £1,000 to any other relative or close friend.

Within these limits, any money you gift to marrying couples will fall out of your estate for IHT purposes.

3. Gift regular sums out of surplus income

Gifting from income could enable you to give unlimited regular financial gifts

To meet the criteria, regular monthly financial gifts must:

- Come from income – employment earnings, pension, or other sources – rather than from savings or capital.

- Not affect your ability to pay your bills or maintain your standard of living.

Making regular financial gifts could enable you to:

- Offer support to family with paying their rent, mortgage, or utility bills

- Pay into a savings account for a child under the age of 18

- Provide financial support to an elderly relative.

Unlike for the other tax rules on financial gifts, there’s no cap on the amount that you can gift in this way.

That said, it’s important to ensure gifts you make are regular – monthly or quarterly, for example – and are paid from income without having a detrimental effect on your own standard of living.

4. Show your generosity with the small gift allowance

You can also give multiple gifts of up to £250 to anyone you’d like each tax year. Although not to someone who has already benefited from one of the above allowances.

That said, if you give birthday or Christmas gifts from your regular income, these sums are typically exempt from IHT.

5. Make additional gifts as “potentially exempt transfers”

Beyond the standard gifting exemptions, there’s nothing to prevent you from gifting as much wealth as you like during your lifetime.

Financial gifts above the allowance outlined here are known as “potentially exempt transfers” (PETs).

Although they can be an effective way to reduce the value of your estate, they only remain exempt from IHT if you survive beyond seven years after making the gift. This is known as the “seven-year rule”.

So, if you pass away within seven years of making a financial gift over and above the rules you’ve read about here, it may become liable for IHT.

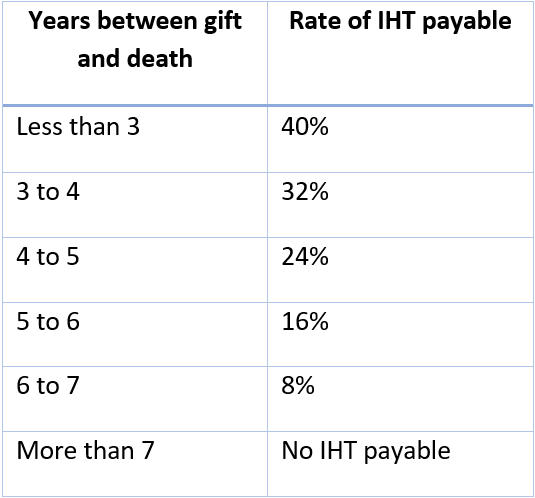

The amount of tax that may become due depends on how long you survive and “taper relief” is applied. Here’s how much IHT may be due on PETs if you pass away within seven years:

PETs can be complex, so it might be wise to consult a financial planner first to ensure that your loved ones aren’t hit with an unexpected IHT bill on any gifts you give.

A final word

However you choose to gift wealth during your lifetime, it’s wise to keep clear and accurate notes about the financial gifts you make. This is especially important if you’re making regular gifts from surplus income, as you may need to prove what you have gifted and when.

With life expectancies increasing, your children may be approaching retirement age themselves by the time you pass away. If you wait until your death to gift them their inheritance, they may not have as much need for it.

So, passing on your wealth when you’re still alive means you may be more likely to gift money when it’s truly needed.

Ultimately, giving financial gifts to people you love during your lifetime allows you the chance to see the positive impact gifts might have.

Get in touch

If you’re unsure whether you can afford the gifts you wish to give, or whether early gifting is a feasible option at all, get in touch. We can help ensure that you and your family benefit as much as possible from your wealth.

Please email us at info@logicfinancialservices.co.uk or check with your adviser.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate estate planning.

Remember that taper relief only applies to gifts in excess of the nil-rate band. It follows that, if no tax is payable on the transfer because it does not exceed the nil-rate band (after cumulation), there can be no relief.

Taper relief does not reduce the value transferred; it reduces the tax payable as a consequence of that transfer.