5 terrifying financial mistakes you’ll want to avoid this Halloween

Halloween is becoming more popular every year. In 2022, Brits spent a reported £687 million on spooky-themed paraphernalia including sweets, chocolate, and costumes.

While trick-or-treaters might be dressing up as ghosts, ghouls, or zombies to scare their neighbours, sometimes it’s the consequences of common financial mistakes that can give you the biggest fright of all.

Read on to discover five of the scariest financial mistakes to avoid this Halloween.

1. Failing to take out financial protection

Two words that can keep even the bravest person up at night are “what if”?

What if you fell ill and couldn’t work for a few months or years? Or worse, how would your family manage financially if you were to pass away?

Fortunately, there are lots of different solutions out there that you can put in place to ensure that, even if the worst happens, your family can remain financially secure. Policies like income protection, critical illness cover, and life insurance can all provide a safety net to protect your family from financial worries.

These sorts of policies can often be indexed too, meaning that the sum assured increases with inflation – albeit alongside the cost of your premiums. Without this addition, you could find that payouts are insufficient to cover your expenses by the time you need to make a claim.

2. Undersaving for retirement

FTAdviser has reported findings from the Department for Work and Pensions that suggest 12.5 million people in the UK are undersaving for their retirement. If you’re one of them, you could be in for a fright when you discover how much your lifestyle may need to change after you finish working.

The key to being able to save enough for the retirement you want is to understand how much your desired lifestyle will cost. When you know this, you can work backwards, figuring out how much you need to put aside each year over the course of your career.

For example, you could look to boost your retirement savings by making the most of employer-matched pension contributions where available, or claiming the correct amount of tax relief on your pension contributions.

3. Losing your retirement savings to scammers

Financial scams become more sophisticated every year, making it increasingly difficult to spot them. Fortunately, there are a few telltale signs you can watch out for to keep your money safe.

Cold-callers talking about investments, pensions, or other financial opportunities

It’s already illegal to cold-call about pensions, and the government is in the process of banning cold-calling about any financial services product, so treat any unexpected calls on these subjects as suspicious.

High-pressure sales tactics

If someone suggests that you need to make a decision about your finances within a short time frame, or that a limited-time offer is about to expire, this could be a scam. Always consult a trusted professional such as your planner, on a number you know, before making financial decisions.

Requests to change your password or enter personal information

Legitimate organisations like your bank won’t ever ask for your password or personal details in an email. Never enter data like this on a link from an email, and always check the sender address of any official-looking messages.

If you’re at all unsure, you should contact the organisation independently of the correspondence you’ve received to confirm whether it is real.

4. Holding too much of your wealth in cash

Cash is sometimes viewed as a “safe haven” because it doesn’t expose your money to risk in the same way as the stock market. But what many people don’t realise is that there’s a monster under the bed of those cash savings: inflation.

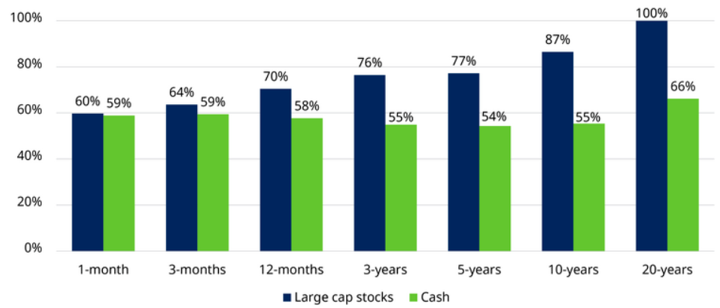

The interest rates on cash savings rarely keep pace with rising prices. As you can see in the graph below, a balanced portfolio offers more opportunities for your wealth to keep pace with inflation than cash savings. The discrepancy between the two becomes more pronounced over longer periods of time.

Percentage of time periods where stocks and cash have beaten inflation, 1926 – 2022

Source: Schroders. Please note that past performance is not a guide to future performance.

Since the buying power of cash savings could be reduced by inflation over time, holding too much of your wealth as cash could make it more difficult to hit your long-term financial goals.

5. Not taking advice from a financial planner

When it comes to your finances, attempting to go it alone can be costly, stressful, and even frightening.

A financial planner can help in many ways, including but not limited to:

- Tax planning to ensure you pay the correct amount of tax

- Estate planning to make sure your loved ones will be financially secure even after you pass away

- Monitoring your investment portfolio and suggesting changes to keep it aligned with your risk profile and goals

- Providing valuable peace of mind during market volatility and times of change throughout your lifetime.

Get in touch

At Logic, we can help to take the fear out of financial planning.

If you’d like to learn more about how we can support you in achieving your financial goals, speak to us today. Please email us at info@logicfinancialservices.co.uk or check with your adviser.

Please note

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

The Financial Conduct Authority does not regulate estate planning, tax planning or will writing.

Note that protection plans typically have no cash in value at any time and cover will cease at the end of the term. If premiums stop, then cover will lapse. Cover is subject to terms and conditions and may have exclusions. Definitions of illnesses vary from product provider and will be explained within the policy documentation.

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.